Product Description

This useful, detailed, and easy to comprehend resource provides an in depth explanation of the annual requirements and compliance processes for your non-profit church.

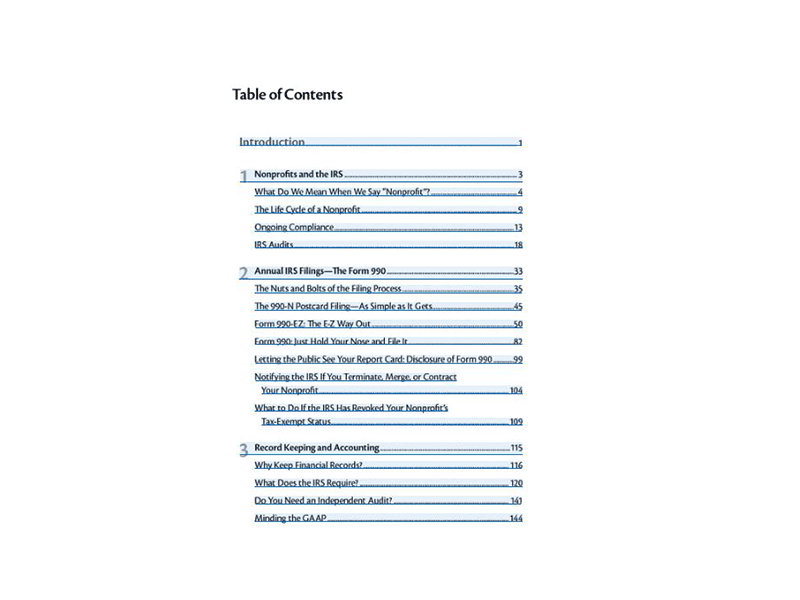

Topics covered include:

- Laws and regulations for charitable donations

- Yearly IRS disclosures, with the F990 form from the IRS

- Details about conflict of interest, tax rules, and UBTI

- Book-keeping for a nonprofit business

- Detailed instructions for F990-EZ

- Restrictions on political activity

Whether you are new to starting a nonprofit, or are already a seasoned professional, this comprehensive guide is sure to prove helpful in preparing your annual filing and properly following all IRS rules.

Note: this book is not meant to be a substitute for professional legal or accounting assistance.